- Find A Loan Officer

- Find A Branch Location

- Buy a Home

- Refinance

- Mortgage Resources

- Loan Servicing Center

-

Frequently Asked Question

4 Minute Read

If you’re thinking about refinancing your existing mortgage, one of the most difficult things to do is getting started. That’s why at Churchill Mortgage we emphasize communication. It is our mission to help you save time and money on your home loan – so we can quickly check if refinancing makes sense for you. If it does, we’ll help you get through the rest of the process quickly.

To make sure you feel confident through all stages of your mortgage experience, your Home Loan Specialist will work with you to build a smarter mortgage plan that guides you every step of the way. A mortgage plan for a refinance is just as important as one for a first-time home buyer because you are replacing your current mortgage with a new home loan that usually has different terms.

Here’s an easy-to-understand view of the refinancing process.

Loan origination is the process of applying for a home loan. This still takes place with a refinance! Once you get your loan estimate (which tells you the important details about the loan you’ve requested) you’ll decide whether you want to move forward with processing or not.

Once your application has been submitted, your mortgage will begin to be processed. The processor will order your credit report, title report, and appraisal and you’ll be asked to:

Once the processor has put together your file with all of the documentation, it is then sent over to underwriting for final approval.

Once your loan is approved, your file is transferred to the closing department where your closing disclosures will be process, your closing day will be scheduled, and your loan is funded.

At the closing of your home you should:

If you have questions about the process of refinancing a home, let us know. We’re here to help! Or if you’d like to apply online and quickly start the process, we’ll have a Home Loan Specialist get back to you about your application status right away.

By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan.

I/we also authorize Churchill Mortgage Corporation, The Churchill Agency and/or their Preferred Provider for our area to contact us regarding but not limited to mortgage and insurance services and products via telephone, mobile phone (including through automated dialing), and/or email, even if telephone numbers or email I/we provide are on any Do Not Call/Contact Registry, such as corporate, state, or the National Do Not Call Registry.

The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. By communicating with us by phone, you consent to calls being recorded and monitored. By participating, you consent to receive text messages sent by an automatic telephone dialing system. Consent to these terms is not a condition of purchase.

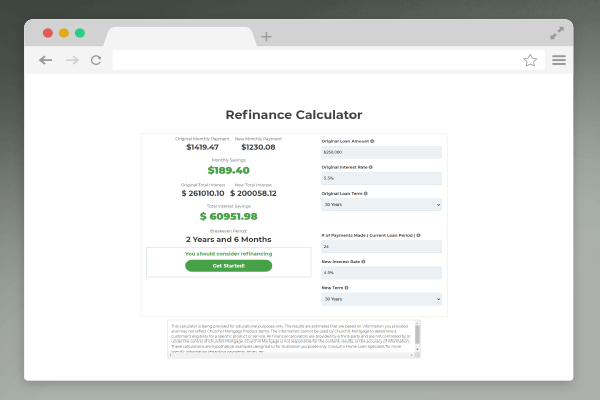

Refinancing can be a vital step in paying off your mortgage early and becoming debt-free. But how do you know when it's the right time to refinance?

Visit Our Refinance Calculator

Refinancing can be a vital step in paying off your loan early and becoming debt-free. Whether you’re looking to convert to a fixed-rate mortgage or lower your loan term, we’ll help you find the home loan you need.

Get Your Free Guide